Trump’s 'big, beautiful bill' directs Treasury to find a replacement for Direct File

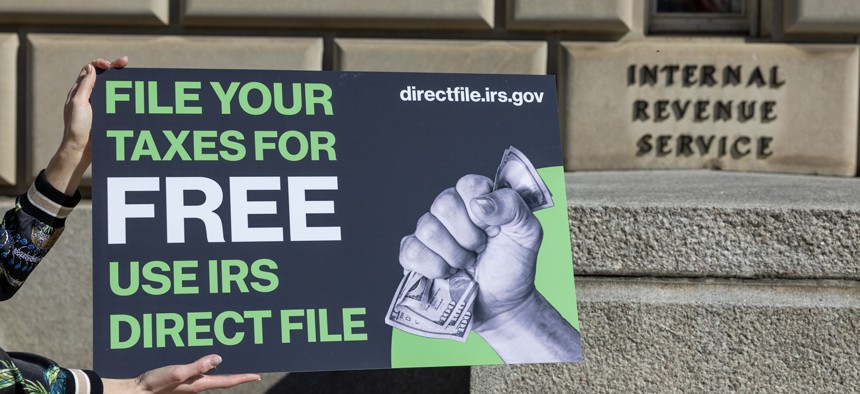

Tasos Katopodis/Getty Images for Economic Security Project

The IRS debuted Direct File — which enabled taxpayers to file online with the agency for free — as a pilot in 2024 and it received largely positive reviews from those that used it.

The “big, beautiful bill" passed by House Republicans Thursday directs the IRS to study how it can replace Direct File, a free, online tax filing system run by the agency during the last two tax filing seasons.

The bill, which extends tax cuts and enacts many of the Trump administration's priorities like immigration enforcement, now heads to the president’s desk, as the Senate passed it days ago.

A previous, House version of the bill included language to officially terminate the online, free tax filing program program, something Republicans have attempted to do before.

But the final reconciliation bill simply sets up a task force to report on how the IRS can replace any direct e-file program run by the agency with public-private partnerships. Republicans are appropriating $15 million for the task force and report, which is due in 90 days.

The IRS has relied on a public-private partnership called Free File for decades to give most Americans a free way to file their taxes, although it's been extremely underutilized. Only 3% of eligible taxpayers used it in recent years.

Some tax prep companies that have been part of the Free File program have pressed people toward paying for products even when they could use free ones, resulting in legal settlements for pushing Americans eligible for free products away from that option and for deceptive advertising.

For a long time, the Free File agreement included a provision that the government wouldn't develop its own solution, thus competing with tax prep companies, although that clause was removed in 2019.

The IRS debuted its own online direct e-filing option, Direct File, as a pilot in 2024 and expanded the option this year. It struggled with uptake amidst media reports about its future, but got good reviews from those that did use it across 25 states where it was offered this year.

Its supporters argue the IRS tool both saves people money on tax prep fees, and helps people get government benefits they’re entitled to and that are delivered through the tax code. Over 296,500 people successfully submitted an accepted tax return this year using Direct File, which the IRS spent $41 million on implementing this filing season.

Since Direct File’s debut, tax prep companies have upped their lobbying efforts, and Republicans have called the tool a “threat to taxpayers’ freedom from government overreach".

The forthcoming report will have to include the cost of public-private partnerships that would give most taxpayers a free tax filing option and replace “any direct e-file programs" run by the IRS; taxpayer opinions on such a program and a free government-run one; a feasibility assessment of the public-private partnership approach; and the cost of a Direct File system.

Democrats, who have panned Republicans’ reconciliation package, had a provision for a similar study on the feasibility and cost of Direct File in their own 2022 reconciliation package, called the Inflation Reduction Act.

Before the launch of Direct File last year, the independent National Taxpayer Advocate within the IRS and the Government Accountability Office had both recommended that the tax agency look at running its own e-file program, citing Free File’s extremely low participation rates, the cost Americans pay to file their taxes via tax prep companies and more.