Deals dip in 2022 but transactions remain at historic highs

In this analysis, KippsDeSanto managing director Kate Troendle explains the multiple factors that will keep merger and acquisition activity in the government market at an all-time high.

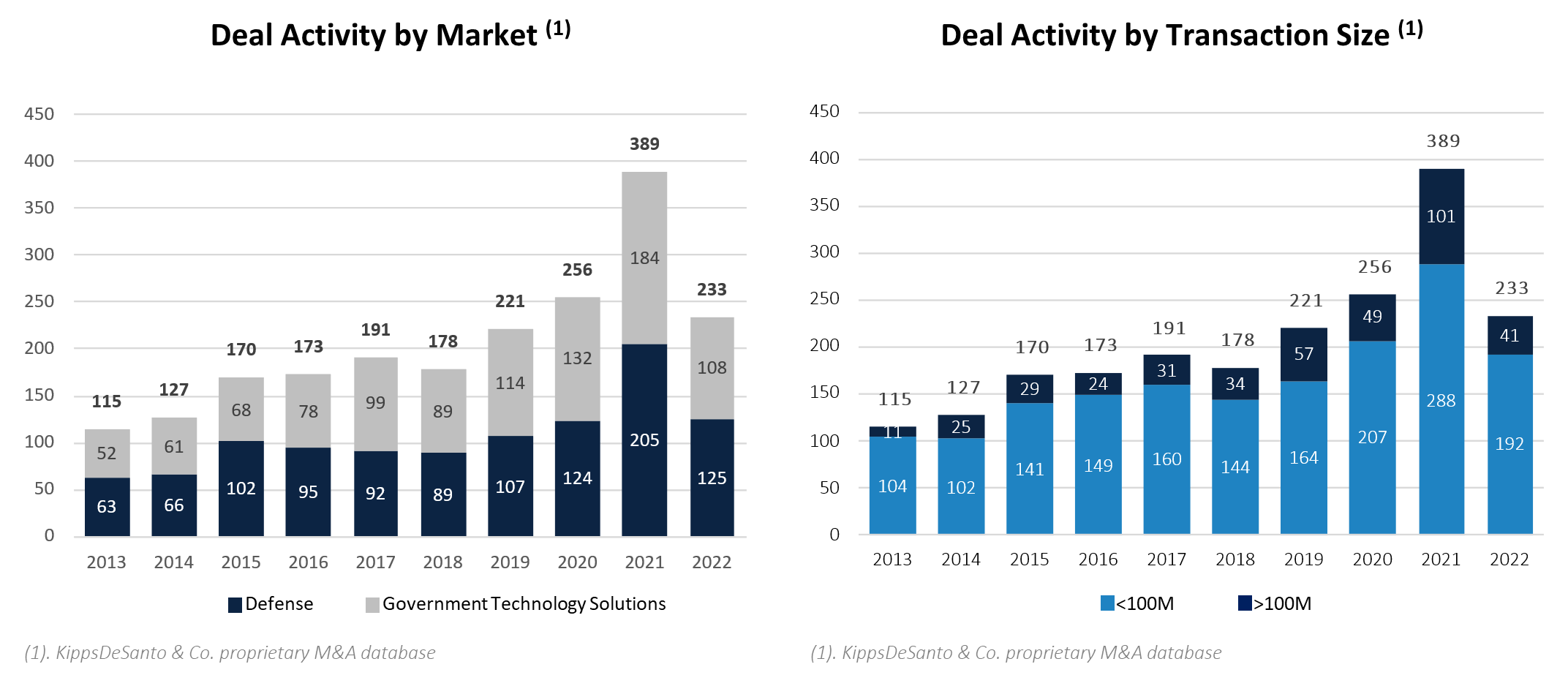

Following historic merger & acquisition activity in 2021, transaction levels returned to more normal levels across the defense and government technology services sectors in 2022. Sector activity was impacted by several high-powered tailwinds and at the same time meaningful headwinds, to create a dynamic market where many deals got done and valuations remained at historic levels.

Noteworthy tailwinds included a continuation of robust federal budget increases, favorable capital market dynamics for defense and GTS companies, and ever-increasing interest from the private equity community. These positive dynamics helped to offset negative impacts associated with rising interest rates, inflationary pressures, and broader economic uncertainty.

As a result, 2022 ended up being a successful year from an M&A perspective, particularly if you view the spike in activity in 2021 as an anomaly.

Across both the defense and GTS sectors, more than 230 transactions were announced, and while this number is considerably lower than 2021, it is in-line with 2019 and 2020, and nearly 50% higher than the average between 2013 and 2018. Nearly 20% of all transactions in 2022 were greater than $100M, which on a percentage basis was in-line with the average since 2013.

While it is easy to focus solely on the decline in activity in 2022, it is important to remember that the M&A market in 2022 was still strong, from both an activity standpoint and a valuation standpoint.

Double Digit Budget Increases Providing Stability Amid Broader Uncertainty

President Biden recently signed into law a $1.65 trillion omnibus spending bill for fiscal 2023, which is ~10% higher than the fiscal 2022 omnibus bill. Given a rising global peer and near-peer threat environment, it was not a major surprise that the 2023 omnibus authorized $858 billion of funding to the Department of Defense, which is 11% (or $95 billion) above the $773 billion DoD request for 2023 and a whopping 16% (or $117 billion) above the enacted 2022 budget.

The DoD and intelligence community budget priorities remain heavily focused on space, missile defense, cyber and information operations, microelectronics, climate change/clean energy, and large-scale IT modernization.

Similarly, civilian agencies received significant budget increases for 2023, despite large increases in 2022, as the administration remains focused on domestic health priorities, climate change initiatives, and broad-based IT modernization efforts.

Some of the largest civilian increases from a dollar perspective include thee Departments of Veteran’s Affairs (a 20% increase to $135 billion), Health & Human Services (a ~9% increase to $121 billion), Department of Homeland Security (~6% increase to $61 billion), and the Department of Housing & Urban Development (an ~8% increase to $58.2 billion). In addition, Environmental Protection Agency and the National Oceanic and Atmospheric Administration received increases of ~6% and ~8%, to $10.1 billion and $6.4 billion, respectively, as climate and clean-energy initiatives remain at the forefront of the current Administration’s agenda.

Public Company Valuations Near or at All-Time Highs

After a meaningful rebound along with the broader market in 2021, public GTS company valuations remained stable in 2022, despite a broader market decline. Public defense companies experienced meaningful stock price appreciation throughout 2022, during which time the S&P decreased ~20%, and are now trading in-line with GTS stocks, at a median Enterprise Value (“EV”) / LTM EBITDA multiple of ~15.0x.

Over the past decade, both indices have appreciated ~500% and seen EBITDA multiples expand ~200% from a median of just above 5.0x in January 2013 to nearly 15.0x currently. Given broader economic uncertainty and out-paced federal budget growth, it makes sense that investors are leaning into the fefense and GTS sectors, which provide some stability in an otherwise volatile stock market, given long-term contracts and solid budgetary fundamentals.

Historically high valuations are allowing public buyers to pay premium M&A valuations without diluting stock prices. This has helped to maintain historically high M&A valuations across the sectors while also fueling M&A activity. Some of the year’s headline grabbing transactions include QinetiQ’s acquisition of Avantus Federal for ~17.0x EBITDA, Booz Allen Hamilton’s $400 million acquisition of EverWatch, Leonardo DRS’s $531 million acquisition of RADA Electronic Industries for ~22.0x EBITDA, and L3Harris’ $4.7 billion acquisition of Aerojet Rocketdyne for 16.5x EBITDA.

In addition, several public companies that have been historically less focused on the Federal landscape with respect to M&A, made sizeable GTS acquisitions in 2022. Such noteworthy transactions include ICF’s acquisition of SemanticBits for $220 million, IBM’s acquisition of Octo, and Tetra Tech’s acquisition of Amyx.

Private Equity Remains a Major Driver for Midmarket M&A Demand

In recent years, there has been a proliferation of private equity interest across the defense and GTS sectors. This trend gained momentum since the beginning of the pandemic for several reasons: most sector-focused private equity groups (“PEG”) raised new and larger funds (e.g., Arlington Capital, Enlightenment Capital, Veritas Capital, etc.) and sought opportunities to put more money to work; newer sector-focused funds ramped up capital deployment (e.g., Arcline, Godspeed, OceanSound, etc.); and traditionally more generalist PEGs turned to the federal sector given strong government market fundamentals and more broad-based market uncertainty.

As a result, the PEG community remained instrumental in stimulating mid-market M&A demand in 2022, as they have been over the past several years. In 2022, more than 50% of acquisitions were completed by PEGs – nearly 20% as a new portfolio investment and more than 30% as add-on acquisitions. This compares to a decade-long average of ~35% of transactions selling to PEGs – ~15% as new portfolio investments and ~20% as add-ons. Each new portfolio created by PEGs represents one more buyer that is likely to be very M&A focused, which is great for perpetuating a strong M&A environment as we look towards 2023.

Throughout 2022, there were only 24 PEG exits across the sectors and 118 acquisitions by PEGs - 39 new portfolio investments and 79 add-on acquisitions. Some of the most headline-grabbing PEG acquisitions in the sector were Carlyle’s $4.2 billion acquisition of ManTech for nearly 16.0x EBITDA and Advent International’s $6.4 billion acquisition of Maxar Technologies for 15.3x EBITDA.

In addition, many new portfolio companies were created by sector-focused PEGs, including Godspeed, DC Capital, and Sagewind, which acquired SilverEdge, Valkyrie, and Federal Advisory Partners, respectively. Additionally, Enlightenment Capital made three new portfolio investments – iNovex, Boecore, and Agile Defense. Defense focused PEGs AE Industrial Partners and Veritas acquired York Space Systems and CAES Space Systems (recently renamed as Frontgrade Technologies), respectively, among others.

Rising Interest Rates, Inflation and Broader Economic Concerns

As determined by the Consumer Price Index, inflation was ~7% in both 2021 and 2022, which has driven up the cost of raw materials and labor and is putting pressure on corporate profits across the country. This is particularly problematic in the federal space, as most companies operate under long-term contracts, which typically allow for minimal allowable annual cost increases.

In addition, it became increasingly more difficult and expensive for businesses to recruit and retain talent over the past two years, as many tech companies were hiring talent away from the government marketplace. This trend, however, may be reversing in favor of government contractors, as many of the largest tech firms, including Amazon, Facebook, Google, Microsoft, and Salesforce, have announced plans to make meaningful reductions to their workforces. To curb mounting inflation, the Federal Funds Rate was increased from just above 0% to the current 4.33%, and further rate hikes are expected in 2023. As a result, the cost of capital became more expensive for buyers that leverage bank financing to fund M&A.

In addition, widespread concerns of a potential recession caused many lenders to limit borrowings and require buyers to use a greater percentage of equity when funding transactions. While this did not have as large an impact on M&A valuations as we may have expected in 2022, it did make it more challenging to get debt-funded acquisitions across the finish line. We are watching the financing market closely as we head into 2023 to see its continued impact on the M&A environment, and in particularly on valuations.

Calm Before the Storm or Sustained Strength Amid Broader Market Uncertainty?

It is difficult to predict how the M&A market will shake out in 2023. As noted, there are many tailwinds (e.g., attractive budgetary dynamics, heightened public company valuations, significant PEG dry power, strong buyer demand for Federal assets, etc.) that support continued M&A activity. However, broader economic headwinds (e.g., inflation, interest rates, capital market volatility, potential recession, etc.) are putting pressure on internal company margins and on M&A valuations. Even if the current M&A cycle peaked in 2021, with respect to deal activity, and in 2022, with respect to valuations, 2023 could still be a highly successful year on both accounts. If valuations were to decline by ~10% or more, they would still be at attractive levels based on the last decade of activity. The same is true for activity – if deal activity dropped by 10%, or ~210 transactions were announced in 2023, it would still be above the 10-year average of ~200. We are therefore optimistic that a healthy M&A environment will continue in 2023 where deals get done, even at strong valuations, particularly for well positioned businesses that are growing and delivering in-demand solutions for high-profile agencies.

Kate Troendle is a managing director with KippsDeSanto & Co. and has 15+ years of M&A experience. She is a graduate of Vanderbilt University and McDonough School of Business at Georgetown University. She may be reached at ktroendle@kippsdesanto.com.

Securities and investment banking products and services are offered through KippsDeSanto & Co., a non-banking subsidiary of Capital One, N.A., a wholly owned subsidiary of Capital One Financial Corporation. KippsDeSanto is a member of FINRA and SIPC. Products or services are Not FDIC Insured, Not Bank Guaranteed, May Lose Value, Not a Deposit, and Not Insured By Any Federal Governmental Agency.