Voyager sets the size, specs of its IPO

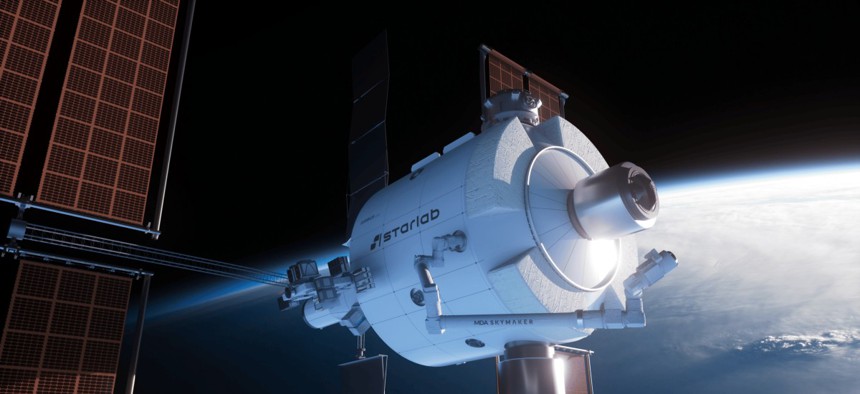

A digital rendering of Starlab. Courtesy of Starlab.

The space and defense systems manufacturer quantifies what it hopes to achieve in the pending initial public offering.

Voyager Technologies has set the terms of its pending initial public offering and the valuation it is seeking to fetch from investors through the sale of stock, according to amended regulatory documents filed Monday.

The space and defense systems maker plans to offer investors 11 million shares at a price range of $26-to-$29 each, which would raise between $286 million and $316 million in capital. The IPO’s underwriters have the option to buy an additional 1.65 million shares if investor demand outstrips the initial supply.

If all goes according to plan, Voyager would hit a valuation of $1.6 billion.

Denver-headquartered Voyager is undertaking its IPO amid wide expectations of increased U.S. government spending on defense and space programs, including the Golden Dome system for protecting the U.S. from incoming missiles.

NASA is Voyager’s largest customer at roughly one-fourth of $144.2 million in revenue for 2024, while work for the U.S. government makes up for 84% of total sales.

The company’s main goal for the IPO is to raise more capital for the further development of Starlab, a commercial space station being offered to replace the International Space Station ahead of ISS’ planned decommissioning in 2030.

Voyager plans to list on the New York Stock Exchange under the symbol “VOYG.”

Goldman Sachs, Bank of America Securities and J.P. Morgan are lead book-running managers. Barclays, Citigroup, Credit Suisse and Morgan Stanley are book-running managers. IMI-Intesa Sanpaolo, MUFG and UniCredit Capital Markets are co book-running managers. Mediobanca is acting as financial adviser to Leonardo.

NEXT STORY: Infleqtion closes $100M Series C round